In a world of rising inflation, unpredictable markets, and ever-evolving lifestyle goals, financial planning has become more than a buzzword — it’s a necessity. From managing daily expenses to preparing for life’s milestones, every decision you make today shapes your financial tomorrow. Yet, many people still navigate money matters reactively rather than strategically, often finding themselves unprepared for emergencies or opportunities that require quick financial decisions.

So, what exactly is financial planning, and why is it vital for everyone — regardless of income or age?

Simply put, financial planning is the process of understanding where you stand today, where you want to be in the future, and how to bridge that gap effectively. It’s not about how much you earn; it’s about how wisely you plan, save, and invest to create financial stability and long-term security.

In this article, we’ll explore the meaning of financial planning, why it’s essential, the steps involved in building a strong plan, and how it helps you achieve financial independence with confidence and clarity.

What Is Financial Planning?

Definition:

Financial planning is the systematic process of evaluating your current financial situation, setting achievable goals, and developing strategies to meet them over time. It brings structure and direction to how you manage money — aligning your financial decisions with your life goals.

Core Idea:

While many equate financial planning with budgeting or investing, it’s far more comprehensive. A true financial plan is a holistic roadmap that connects every part of your financial life — income, expenses, savings, investments, taxes, insurance, and retirement. It ensures that each element supports the other, creating balance and sustainability in your financial ecosystem.

Purpose:

The main goal of financial planning is to help you manage your current resources efficiently while preparing for both expected and unexpected future needs. It allows you to handle life’s uncertainties — from medical emergencies to career transitions — with confidence, ensuring you stay aligned with your short-term and long-term aspirations.

Key Concept:

At its heart, financial planning builds discipline, clarity, and control. It transforms money management from guesswork into a structured process, empowering you to make informed decisions, stay financially resilient, and work steadily toward your version of financial freedom.

Why Is Financial Planning Important?

Financial planning isn’t just about managing money — it’s about managing your life with intent. A well-structured financial plan acts as both a compass and a safety harness: it helps you stay on course toward your goals while protecting you from unexpected financial turbulence. Here’s why it matters so much:

Financial Goal Achievement

Every dream — whether it’s buying a home, funding your child’s education, taking a world trip, or retiring early — comes with a price tag. Financial planning helps you define these goals clearly and map out how to reach them systematically. By breaking big dreams into measurable milestones, you turn aspirations into achievable outcomes.

Financial Security

Life is unpredictable. From medical emergencies to sudden job loss, unplanned events can derail your stability. Sound financial planning builds a cushion — an emergency fund or insurance coverage — to safeguard you during such times. It’s not just about having money; it’s about having peace of mind.

Better Money Management

Without a plan, money tends to slip through unnoticed cracks. Financial planning gives you a clear picture of your income, spending, savings, and debts. It enables smarter allocation of funds, helps reduce unnecessary expenses, and fosters better saving habits — ensuring every rupee you earn has a purpose.

Retirement Readiness

Retirement should be about freedom, not financial worry. Through early and consistent planning, you can accumulate enough wealth to sustain your lifestyle even when your income stops. A disciplined financial plan ensures that you not only retire comfortably but also maintain your independence and dignity through your later years.

Tax Optimization

Strategic financial planning isn’t just about earning more — it’s also about keeping more. By choosing the right investment avenues and tax-saving instruments, you can minimize your tax liabilities while simultaneously working toward your financial goals. It’s a win-win for both short-term relief and long-term growth.

Flexibility & Adaptability

Your financial plan should evolve as you do. Changes in income, family dynamics, or life priorities require adjustments. Regular reviews ensure your plan remains relevant, resilient, and responsive — keeping you on track no matter how life shifts around you.

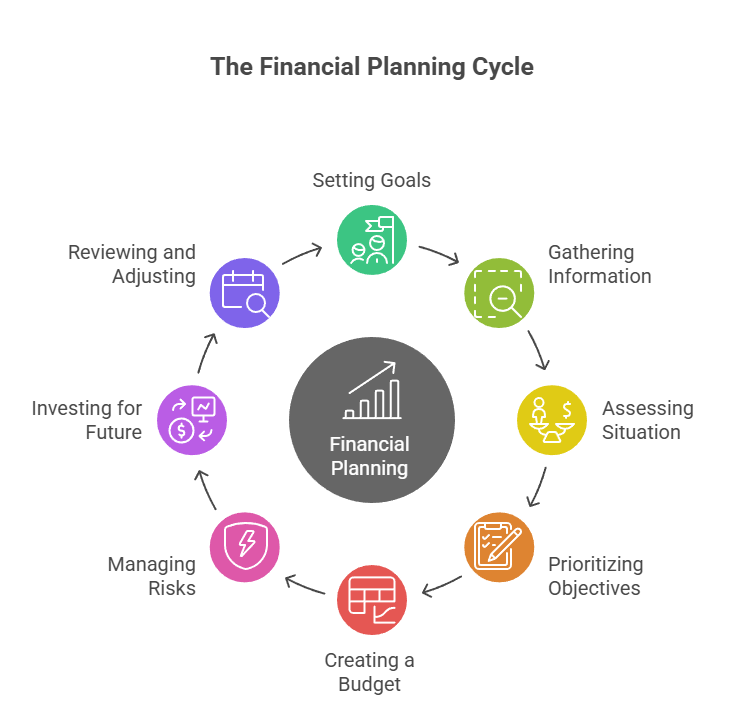

The Financial Planning Process

Building a robust financial plan is like constructing a strong foundation — it requires method, structure, and continuous reinforcement. Below are the essential steps that guide this journey.

Step 1: Setting Goals

Begin by identifying what you want to achieve financially — both in the short term (like buying a car or repaying debt) and the long term (like owning property or retiring early). The clearer your goals, the sharper your plan.

Example: Setting a goal to save ₹10 lakh for a down payment within five years provides direction and measurable progress.

Step 2: Gathering Information

Next, collect all relevant financial data — income, expenses, liabilities, assets, insurance policies, and tax details. This is your financial snapshot.

Understanding where your money comes from and where it goes helps you assess your financial capacity realistically.

Step 3: Assessing Your Current Financial Situation

Evaluate your present financial health by comparing your assets and liabilities, income and expenses, and savings and debts. This step helps you identify gaps between where you are and where you need to be.

Step 4: Identifying and Prioritizing Objectives

Not all financial goals are equally urgent. Some are essential — like insurance or emergency funds — while others are aspirational, such as upgrading your car. Prioritizing ensures your most important needs are addressed first without compromising long-term stability.

Step 5: Creating a Budget

A practical budget acts as your daily financial guide. Allocate funds toward essentials, savings, investments, and leisure — in that order.

Include a dedicated emergency fund (typically 3–6 months’ worth of expenses) to handle unforeseen events without disrupting your plan.

Step 6: Managing Risks

Every financial plan should prepare for the “what ifs.” Adequate insurance — life, health, property, and accident — forms the backbone of risk management.

This step shields your family and finances from setbacks that could otherwise erase years of hard work.

Step 7: Investing for the Future

Once the basics are in place, channel your surplus into investments aligned with your goals, time horizon, and risk tolerance. Whether it’s mutual funds, fixed deposits, real estate, or equities, diversification ensures stability and growth over time.

Example: A young professional might focus on equity-based investments, while someone nearing retirement may prefer low-risk options.

Step 8: Reviewing and Adjusting

Financial planning isn’t a one-time activity — it’s a living process. Revisit your plan regularly to reflect income changes, inflation, or evolving goals.

Periodic reviews keep you agile, ensuring your plan continues to serve your best interests no matter how life unfolds.

Conclusion

Financial planning is more than crunching numbers or chasing returns — it’s about designing the life you want, with the resources you have. It transforms uncertainty into strategy, and impulse into intention. Whether you’re at the start of your career or nearing retirement, a solid financial plan ensures every decision you make today contributes meaningfully to your tomorrow.

By understanding your goals, managing risks, saving smartly, and reviewing regularly, you give yourself more than financial stability — you gain freedom of choice. Freedom to explore, to build, and to live life on your own terms without fear of what lies ahead.The truth is, you don’t need to be rich to plan — but you do need a plan to be truly rich. Start small, stay consistent, and remember: financial planning isn’t a one-time event; it’s a lifelong habit of empowerment and growth.

Frequently Asked Questions (FAQ)

1. Why is financial planning important for everyone?

Financial planning helps you manage your money efficiently, prepare for emergencies, achieve your life goals, and secure your future. It’s not just for high-income earners — it’s for anyone who wants to make smarter financial decisions and reduce stress around money.

2. What are the first steps to start financial planning?

Begin by assessing your current financial situation — your income, expenses, debts, and savings. Then, define your short-term and long-term goals, create a budget, and start saving or investing regularly. If needed, consult a certified financial planner for expert guidance.

3. How often should I review my financial plan?

Ideally, you should review your financial plan at least once a year or whenever there’s a major life change — such as a job switch, marriage, new investment, or change in income. Regular reviews keep your plan aligned with your evolving goals and circumstances.

4. What is the difference between financial planning and budgeting?

Budgeting focuses on day-to-day income and expense management, while financial planning takes a broader view — covering your savings, investments, taxes, insurance, and long-term goals. Budgeting is one piece of the larger financial planning puzzle.

5. Can I do financial planning on my own, or should I hire a professional?

You can absolutely start on your own using online tools, budgeting apps, and investment platforms. However, if your finances are complex or you’re unsure about investment strategies, working with a certified financial planner (CFP) can provide personalized strategies and expert insight.